Industry News: Coffee Pricing 101

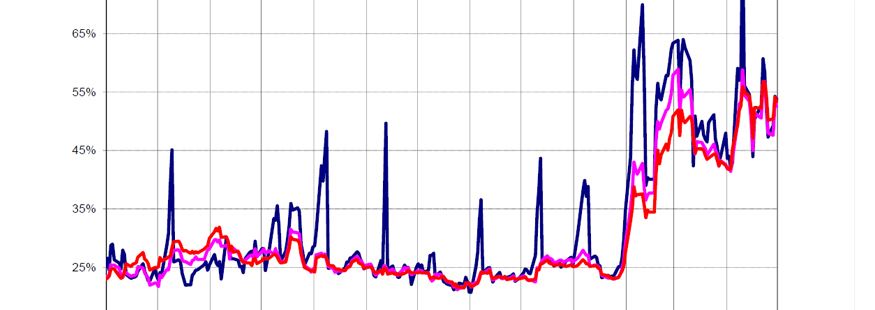

Global coffee prices have been in the spotlight in recent weeks after having experienced a very sharp and rapid rise.

We thought it would be a good opportunity to go back to basics and explain how the international coffee market works when it comes to pricing.

To do this, we first need to take a look at the coffee

futures market, as it is the base on which the majority of coffee is priced at

origin.

There are two different futures contracts which cover both Arabica and Robusta coffee markets:

- The Arabica coffee contract, commonly known as the ‘C’ contract, which is traded on the Intercontinental Exchange (ICE) in New York and;

- The Robusta coffee contract, which trades on the NYSE Liffe Exchange in London.

At its core, a futures contract is an agreement between a seller and a buyer to buy or sell goods at a certain point in the future (hence its name) for an agreed price. In order for market participants to know exactly what they are buying and/or selling, the future contract is standardized to certain specifications, or ‘specs’. The specs for the ‘C’ contract can be found here, and those for the Robusta contract can be found here.

Participants in the Coffee Futures market have the ability to deliver or take delivery (depending on which side of the transaction they are sitting on) of actual physical coffee according to a strict set of rules outlined in the specs. Delivery periods (also known as settlements) are standardized, and occur on alternate months.

In a nutshell, a futures contract is a standardized forward contract which is traded on an open market through an exchange. Having laid that (very) basic groundwork, we can now move along towards understanding how pricing works.

Because the coffee deliverable into a futures contract is of a known grade and quality, sellers (i.e. growers, traders and exporters) have a pretty good idea of how their particular coffee compares to that benchmark. Therefore, if a seller’s coffee is of an inferior grade to the standard set in the contract (or perhaps in less demand), they will usually sell it at a discount to the futures contract. Conversely, if the coffee is of a superior grade, or more sought after, it can sell at a premium. These premiums and discounts are commonly referred to in the trade as ‘differentials’ or ‘diffs’.

Differentials also respond to demand and supply, and in certain scenarios discounts can quite easily become premiums. For example, if there were to be a shortage of a particular coffee that generally traded at a discount to the ‘C’, that coffee’s differential could become a premium as a result of high demand in the face of limited supply.

Shifts in demand can affect differentials as well. For instance, if consumers decide they don’t like Geisha coffees anymore (how could they, honestly… but I digress…), and now prefer Red Bourbon coffees, the differentials will experience a movement that will reflect this change in consumer preference.

Prices on the international market generally trade based on the differential, unless an outright price is quoted (i.e. USD 4500/ton). The final price will therefore be the ‘C’ price plus (or minus) the differential quoted.

Let’s see how it all ties in with a (very) basic example:

- Colombian Arabica is quoted for September-2014 delivery at “September plus 30”.

- In this context, “September” refers to the September 2014 ‘C’ contract, and “plus 30” is the differential, which is a premium of 30 US cents/lb.

- This means the final price of that coffee will be the sum of both those components. If the September ‘C’ contract is trading at about 180 US cents/lb, the final price of that coffee would therefore be 210 US cents/lb (i.e. 180 + 30).

Fixing the price of coffee in advance allows traders to offer forward prices to roasters, as long as roasters are happy to lock in those prices in advance. This also depends on consumers’ willingness to commit to forward-purchasing from roasters. Therefore, for a forward-pricing scheme to work, there needs to be a certain level of coordination, communication and commitment between traders, roasters and consumers.