The Nyeri Situation: An Update from Ground Zero

Bennetts were fortunate enough to visit Kenya and Ethiopia earlier this year to spend time with our suppliers, cupping and planning for the upcoming season. Whilst in Kenya we were keen to gauge a further understanding of the continuing situation in Nyeri.

We were able to meet

with both cooperative producers and private exporters to hear from both sides

of the dispute. It is of utmost priority that Bennetts act as an informed

resource for our customers, so we thought it best to offer an overview of

how we see the situation upon our return from ground zero.

CHANGES TO THE KENYAN MARKETING MODEL

Changes in the political landscape have

brought new levels of control and influence to local government in Nyeri. The

Governor Nderitu Gachagua has sought to bring a new operational structure to

the local coffee industry by declaring that all coffee in the region will now

be processed at a centralized mill called Sagana, owned and run by the Kenyan

Planters Co-Operative Union (KPCU).

In conjunction with centralized milling, a marketing and exporting agency has been established (KCCE) to explore end-to-end farming, processing and marketing of small holders produce in an effort to further maximise their returns. The mandate for Kenya Cooperative Coffee Exporters Limited (KCCE) is to create linkages between the Smallholder Kenyan Coffee producers and the world market through a consistent, timely and transparent supply chain. KCCE has its own export license and is non-profit.

It is purported by KCCE that smallholder coffee farmers in Kenya have wanted to market their coffee directly to buyers overseas and create business relationships with their buyers, but lacked the necessary linkages to do so. Most of their coffee has been handled by intermediaries or traders (mostly global multinational companies), a situation that is perceived as lengthening the value chain and eroding value for farmers. This has now been addressed with the formation of KCCE as the farmer’s vehicle to the international market through the direct sales approach also referred to as the “second window” introduced in Kenya in 2005.

As you may be well aware the second window operates alongside Kenya’s traditional coffee auction system. Lower and commercial grades are generally sold through the exchange with specialty through the second window. The sale price for coffee through the second window is a process of negotiation between the buyer, KCCE and the Cooperative. KCCE and the county governance believe they are working to return control, transparency, fair market value and profit back in favor of the farmers.

Under the previous model, coffee cherry was sold at the wet mill, transferring ownership to the private marketer who would then process and export the coffee. The farmer had no knowledge to whom the coffee was eventually sold or for what price.

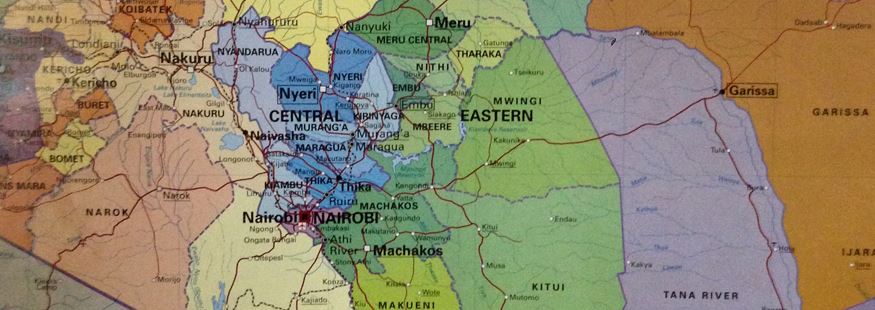

We visited a cooperative called Barichu in the region of Nyeri. Coffee farms in this area lie in the foothills of Aberdare ridge and overlooked by Mt Kenya. Altitude ranges from 1220-2300 MASL. Barichu have a total of 4 wet mills; Karatina, Karindundu, Gaturiri, Gatomboya. We were offered the privilege of being invited to attend discussions between the Cooperative committee, County Government representatives and farmers. We were given an explanation as to why the farmers felt compelled to take control by forming KCCE; in order to facilitate the marketing of their coffees rather than being reliant upon existing marketing agents represented by the multinationals and private exporters.

PRIVATE MARKETING COMPANY PERSPECTIVE

The private marketers reacted with outcry to the declaration that all Nyeri country coffees were to be milled separately and exported and marketed directly through KCCE, as they felt they were being denied access to traditional supply lines out of the region. Many have invested serious funding into implementing certification and management systems into the district and its producers. There are also fears that the integrity of the coffee may be compromised. The underlying assumption is that KCCE is not prepared nor equipped to handle such a large volume of quality coffee and this could create problems along the supply chain. There is a perception that the farmers are ignorant and that the Governor is using the situation for political ends.

It must be said that the marketers are not against change in the marketing system per-se that may or may not bring better understating and or price for the farmers, however they are opposed to the timing of the transition right at the beginning of the 2014 season as it provides for significant destabilization. An additional repercussion has been that auction prices have been unnecessarily high because there is such a limited amount of coffee, due to the Nyeri region stockpiling and looking to market directly. The traditional marketing agents may have made provisions in their forward sales for a percentage of Nyeri coffee, and are now forced to purchase at inflated prices from the weekly auction in order to secure volumes.

This has all come about from a perception that the private marketers have been making outrageous amounts of money at the expense of the farmers. The farmers do not seem to appreciate the costs incurred by the private marketing agents, or understand that a percentage of their sale price for coffee in the external market must be directed to covering theses costs and add value for their shareholders. Farmers seem to be of the belief that a greater percentage of the sale prices should be for their keeping.

The private marketers have made significant financial investments to improve productivity and quality to ultimately achieve higher prices and better returns for the farmers as well as their shareholders. Private marketers now feel that the ‘rug has just been pulled from beneath them’ without consultation or recourse. Coffees from traditional wet mills are no longer accessible forcing the marketers to look further afield. This has caused much consternation among the industry.

WHAT ARE THE IMPLICATIONS FOR THE IMPORTER AND ROASTER?

Prior to travelling to Kenya my understanding of the situation had been fashioned by my reading of commentary issued by the private marketing entities. It was not until I had the opportunity to hear from cooperative members and a selection of farmers directly that I became appreciative of a different perspective; that of collective movement with a desire for greater transparency, empowerment and control. The message being conveyed by these producers was that the changes were in fact welcomed.

Ultimately, Bennetts wish to support a system that affords everybody the opportunity to access the best coffees available and ensures that the producers of these coffees are correctly and fairly remunerated for their labour and coffee production expertise.

Ensuring a sustainable and transparent coffee production and marketing system seems to be the end goal for all; how this is achieved and governed it seems is not so clear. We will continue to watch the situation unfold in Nyeri, the outcome of which will help to set the tone for a potentially lasting change in the way coffee is marketed out of Kenya.